You are here:Bean Cup Coffee > chart

**Wrapped Bitcoin Price Prediction 2030: A Glimpse into the Future of Cryptocurrency Valuation

Bean Cup Coffee2024-09-20 13:49:00【chart】8people have watched

Introductioncrypto,coin,price,block,usd,today trading view,**As we stand on the brink of a new decade, the cryptocurrency market continues to evolve at a rapid airdrop,dex,cex,markets,trade value chart,buy,**As we stand on the brink of a new decade, the cryptocurrency market continues to evolve at a rapid

As we stand on the brink of a new decade, the cryptocurrency market continues to evolve at a rapid pace. Among the various digital assets, Wrapped Bitcoin (WBTC) has emerged as a significant player, offering a unique blend of Bitcoin's security and blockchain interoperability. With the year 2030 fast approaching, it is intriguing to ponder the potential trajectory of Wrapped Bitcoin's price. This article aims to provide a comprehensive analysis of the Wrapped Bitcoin price prediction 2030, considering various factors that could influence its valuation.

Firstly, it is essential to understand what Wrapped Bitcoin is. Wrapped Bitcoin is a tokenized version of Bitcoin that operates on the Ethereum blockchain. It allows users to trade, store, and use Bitcoin on the Ethereum network, thereby bridging the gap between the two dominant blockchains. This innovative approach has made Wrapped Bitcoin a popular choice among investors and developers alike.

The Wrapped Bitcoin price prediction 2030 hinges on several key factors. One of the most significant factors is the growing adoption of blockchain technology across various industries. As more businesses and governments embrace decentralized platforms, the demand for Wrapped Bitcoin is likely to increase. This increased demand could lead to a surge in its price over the next decade.

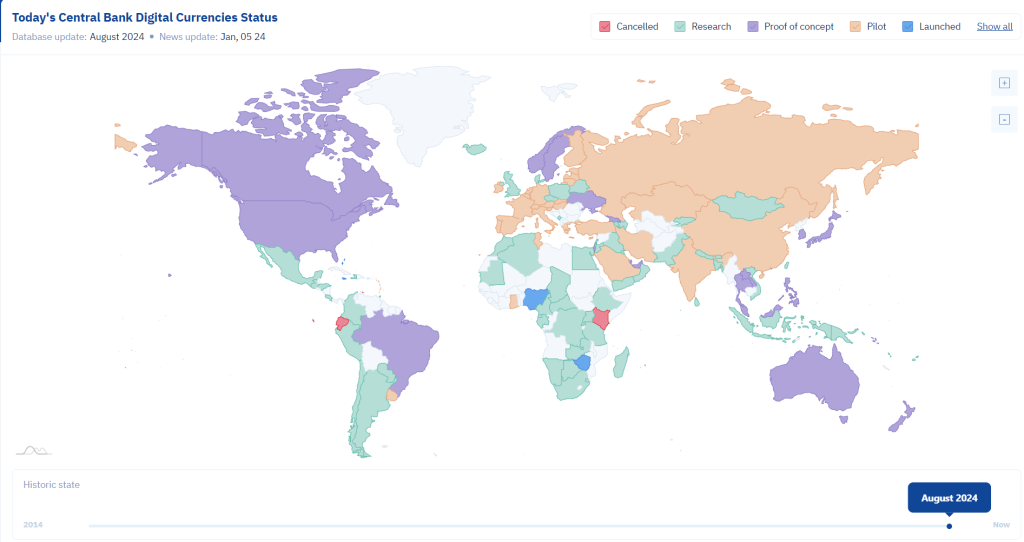

Another crucial factor to consider is the regulatory landscape. The regulatory framework for cryptocurrencies is still evolving, and changes in regulations could have a profound impact on Wrapped Bitcoin's price. For instance, if governments around the world adopt a more favorable stance towards cryptocurrencies, it could lead to a surge in Wrapped Bitcoin's price, as investors would feel more confident in holding and trading the asset.

Technological advancements also play a pivotal role in the Wrapped Bitcoin price prediction 2030. The Ethereum network, on which Wrapped Bitcoin operates, is continuously improving, with projects like Ethereum 2.0 aiming to enhance scalability and reduce transaction costs. As these improvements are implemented, the value of Wrapped Bitcoin could increase, as it becomes more efficient and cost-effective to use.

Furthermore, the correlation between Wrapped Bitcoin and Bitcoin's price is another critical aspect to consider. Since Wrapped Bitcoin is essentially a tokenized version of Bitcoin, its price is closely tied to the price of Bitcoin itself. If Bitcoin's price continues to rise, as many analysts predict, Wrapped Bitcoin's price is likely to follow suit. This correlation makes Wrapped Bitcoin an attractive investment for those who believe in Bitcoin's long-term potential.

However, it is important to note that predicting the Wrapped Bitcoin price prediction 2030 is not without its challenges. The cryptocurrency market is known for its volatility, and numerous external factors, such as geopolitical events and market sentiment, can influence prices. Additionally, the rapid pace of technological innovation and regulatory changes can make it difficult to forecast the future accurately.

In conclusion, the Wrapped Bitcoin price prediction 2030 is a complex topic that requires careful consideration of various factors. While there are several reasons to be optimistic about the future of Wrapped Bitcoin, including growing adoption, favorable regulatory changes, and technological advancements, the inherent volatility of the cryptocurrency market makes precise predictions challenging. However, by keeping a close eye on these factors and remaining adaptable to changing circumstances, investors can better position themselves to capitalize on the potential growth of Wrapped Bitcoin in the coming years.

This article address:https://www.nutcupcoffee.com/blog/54b56799378.html

Like!(1442)

Related Posts

- Bitcoin, Ripple, and Ethereum: The Dynamic World of Cryptocurrency Prices

- Why Does Bitcoin Halving Increase Price?

- Live Bitcoin Price Graph: A Window into the Cryptocurrency Market

- Can I Buy Bitcoin Through Chase?

- Buy Bitcoin with Cash in Brooklyn, NY: A Guide to Secure and Convenient Transactions

- Can You Use Binance US in Washington State?

- Case Bitcoin Wallet: A Comprehensive Guide to Secure Cryptocurrency Storage

- Can U Lose Money in Bitcoin?

- How to Find Bitcoin Wallet Address: A Comprehensive Guide

- Binance MCO Volume Traded on Your Account: Understanding the Importance and How to Monitor It

Popular

Recent

Bitcoin Mining Taxes in the United States: Understanding the Implications

Bitcoin Price 2019 Year: A Year of Volatility and Hope

Bitcoin Mining in New Jersey: A Growing Industry in the Garden State

Crypto.com vs. Binance Fees: A Comprehensive Comparison

The Price of a Share of Bitcoin: A Comprehensive Analysis

Can You Use Binance US in Washington State?

Bitcoin Cash to USD Chart: A Comprehensive Analysis

Bitcoin Mining in New Jersey: A Growing Industry in the Garden State

links

- Bitcoin Mining GPU vs CPU: Which is More Efficient?

- Sri Lanka Bitcoin Mining: A Growing Industry in the Island Nation

- Best Android Bitcoin Wallet: The Ultimate Guide to Securely Managing Your Cryptocurrency

- **How to Move Bitcoin from Coinbase to a Hardware Wallet

- Title: Exploring the World of Fee Trading on Binance

- How to Trade USDT to BNB on Binance: A Step-by-Step Guide

- **Trust Wallet Binance: A Comprehensive Guide to Secure Crypto Management

- Binance Voucher Code USDT: A Comprehensive Guide to Unlock Exclusive Benefits

- Can I Buy Bitcoin with 401k Funds?

- How to Get Binance Smart Chain on Metamask: A Comprehensive Guide